cupicup.ru

Community

Contributing To Both 401k And Ira

If you're eligible, you can contribute to both a Roth and traditional IRA in the same year—though you can only contribute up to the annual contribution limit. If you are under age 50, you may contribute $7, a year. If you are age 50 or older, you may contribute $8, a year. Income requirements. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. The contribution limit for Traditional and Roth IRAs increased to $7, Employees age 50 or older are eligible to contribute an additional $1,, for a total. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ Your total contributions to both your IRA and your spouse's IRA may not exceed your joint taxable income or the annual contribution limit on IRAs times two. Source: "(k) limit increases to $23, for , IRA limit rises to $7,," Internal Revenue Service, November 1, IRA deduction limits — You are. If you have earned income, you can put money into both a (k) plan and an IRA. · For , a (k) lets you save $23, ($30, if you're 50 or older). If you're eligible, you can contribute to both a Roth and traditional IRA in the same year—though you can only contribute up to the annual contribution limit. If you are under age 50, you may contribute $7, a year. If you are age 50 or older, you may contribute $8, a year. Income requirements. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. The contribution limit for Traditional and Roth IRAs increased to $7, Employees age 50 or older are eligible to contribute an additional $1,, for a total. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ Your total contributions to both your IRA and your spouse's IRA may not exceed your joint taxable income or the annual contribution limit on IRAs times two. Source: "(k) limit increases to $23, for , IRA limit rises to $7,," Internal Revenue Service, November 1, IRA deduction limits — You are. If you have earned income, you can put money into both a (k) plan and an IRA. · For , a (k) lets you save $23, ($30, if you're 50 or older).

You can save more by contributing the maximum to each account. · You can utilize tax advantages, especially if one of those accounts is a Roth. · You can maximize. If you're not sure where your tax rate, income, and spending will be in retirement, one strategy might be to contribute to both a Roth (k) and a traditional. Depending on your income and whether or not your spouse also has a (k), you may max out both your (k) and IRA contributions in the same year. In other. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). Contribute the maximum allowed to your IRA. Go back to your (k) plan and contribute beyond the match to the annual maximum allowed, if possible. The maximum annual contribution allowed for Roth IRAs, traditional IRAs or a combination of both is $6, for tax year and $7, for tax year (If. The government limits how much you can save through retirement plans each year. However, (k)s have much higher contribution limits. In , you can save up. Unlike Roth IRAs, income limits don't apply for PSR Roth contributions. Also, PSR (k) and plans have the advantage of higher contribution limits than a. K. retirement contributions While both plans provide income in retirement, each plan is administered under different rules. A K is a type of employer. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income. Contributions to Roth IRAs, and Roth (k) contributions rolled over to Roth IRAs, can be accessed tax- and penalty-free at any point. If you withdraw more. It is possible to contribute to both a (k) and an IRA for retirement savings. • (k) plans are employer-sponsored and allow both employee and employer. Both employees and employers may contribute to the plan. Most people select either a Traditional (k) or a Roth (k), depending on what's made available by. As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. Yes, you can do both a k and a traditional/roth IRA. They're considered separate retirement options and have separate contribution limits. Yes, under certain circumstances you can have both a k and a Roth IRA. Understand the rules for contributing to a (k) and a Roth IRA, including limits. Roth IRA contributions, by comparison, are capped at $6,—$7, if you're 50 or older. Matching contributions: Roth (k)s are eligible for matching. The answer is yes. In fact, this is the most ideal situation for individuals as it allows you to take advantage of the various tax benefits of both retirement. (k): $22,, plus $7, in catch-up contributions for participants 50 and older. Maximum total contribution limits (employer + employee) (). SEP IRA.

Worldremit Paypal

WorldRemit is a digital cross border remittance business that provides international money transfer and remittance services in more than countries and. WORLDREMIT. Zenith Bank Plc is in partnership with World Remit (a global money transfer and payment company) with network spanning over 58 countries and Compare PayPal vs WorldRemit. Wise uses the REAL exchange rate and charges a low, transparent fee. Our Mobile app. Remit in Just a Minute. With IME Pay, receiving money across borders is now just a tap away! Access your account, enter remittance details. Compare PayPal vs WorldRemit. Wise uses the REAL exchange rate and charges a low, transparent fee. A remittance is money that is sent from one party to another. Broadly speaking, any payment of an invoice or a bill can be called a remittance. WorldRemit is the winner against Paypal despite not having business specific benefits. The main reason is Paypal has high additional fees and markups within. Compare PayPal vs. WorldRemit using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best choice for. Fast & convenient, this money transfer app enables you to send money abroad. WorldRemit is a digital cross border remittance business that provides international money transfer and remittance services in more than countries and. WORLDREMIT. Zenith Bank Plc is in partnership with World Remit (a global money transfer and payment company) with network spanning over 58 countries and Compare PayPal vs WorldRemit. Wise uses the REAL exchange rate and charges a low, transparent fee. Our Mobile app. Remit in Just a Minute. With IME Pay, receiving money across borders is now just a tap away! Access your account, enter remittance details. Compare PayPal vs WorldRemit. Wise uses the REAL exchange rate and charges a low, transparent fee. A remittance is money that is sent from one party to another. Broadly speaking, any payment of an invoice or a bill can be called a remittance. WorldRemit is the winner against Paypal despite not having business specific benefits. The main reason is Paypal has high additional fees and markups within. Compare PayPal vs. WorldRemit using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best choice for. Fast & convenient, this money transfer app enables you to send money abroad.

Payment Requirements (Receiver). Customer shares either their Naira or USD account with sender; Once transaction is sent by sender, Customer walks into any of. How do I pay for my transfer in South Africa? When sending money from South Africa, you can pay for your transfer using any of the following ways: Debit, credit. WorldRemit is one of the leaders in the online money transfer industry. Being founded in in the UK, this company has expanded to allow customers in over Paypal/Xoom, cupicup.ru Worldremit, cupicup.ru b) Outward/Outbound/Send Service: allows customers of Airtel to send money. Download our app for free to send money online in minutes to over other countries. Track your payments and view your transfer history from anywhere. WorldRemit lets you send money abroad with a smartphone, tablet or computer. Your transfer is done completely online, unlike traditional money transfer. We'll provide you with the total cost and delivery time before you send your transfer. Choose a payment method that works for you, such as a debit or credit. PayPal enables easy payments to be sent to an email address by entering the recipient's details, amount, and payment type on the platform and sending. About this app. arrow_forward. Remit Choice is a diversified platform for money transfer with faster, safer and easier mode of service. With Remit Choice you. You can send money up to US$1, from the US to the Philippines through ACH transfer. Simply connect your bank account to the Kabayan Remit app to enjoy. Download our app for free to send money online in minutes to over other countries. Track your payments and view your transfer history from anywhere. Black. Mobile money stores funds in a secure electronic account linked to a mobile phone number. In some cases the wallet number will be the same as the phone number. pros. Varying tariff plans available. Extensive integration. Developer Tools. Universal payment system. cons. Problems with. Dial *#; Enter PIN. Options. Send Money; Make Payment; Cash Out; Buy airtime & bundles; Junior Wallet; Wallet Services for Online payments. Xoom is a PayPal service that allows you to send money to your friends and family around the world. pay with all of your saved PayPal payment methods. © World Central Kitchen. (c)3 nonprofit organization | EIN: Privacy Policy. Cookies Settings. By clicking “Accept All Cookies”, you agree to. REMIT MONEY. Rewards. Earn Cashpoints on Every payment. Earn cash points every time you send money on Remit Money. Earn Rs.1(10 Pts) on every Rs. sent. Money in motion, connecting the world. Thunes is building a global payment infrastructure for a better payment experience. With a single, simple connection. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. @DGMunhungeyi @WorldRemit What a great money remittance platform! Is PayPal @WesternUnion · · @JimmyJamesNd @WorldRemit Not working.

Create Your Own Crypto Token

Using Token Tool, users can mint their own Coinbase Base tokens within minutes. You only need to specify the blockchain network, token standard, and token. 2. Write ERC Token Smart Contract · Open up the my-token project in your code editor. · Navigate to your /contracts folder · Open a cupicup.ru file and name the. Read this guide to find out how you can create a cryptocurrency token in different ways and on various blockchains. create erc20, bep20 token and smart contract · Apcode ; do coinmarketcap circulating supply API for listing token · Sanjit ; create your own crypto memecoin, token. Create a token, create a coin for your project or yourself, or just trade others' coins. Craft your shiny new meme coin and turn your meme-tastic dreams into. Create your own cryptocurrency by joining hands with one of the Leading Cryptocurrency Coin Development Service provider, Shamlatech. Want to create your own token but unsure of how to start? Contact our expert crypto developers to launch crypto coin projects. What is createmytoken? createmytoken is an easy-to-use token generator for creating a ERC20/BEP20 Token on the Ethereum Blockchain or Binance Smart Chain. There. 1. Creating Your Own Blockchain and Cryptocurrency You can write your own code to create a new blockchain that supports a native cryptocurrency. Using Token Tool, users can mint their own Coinbase Base tokens within minutes. You only need to specify the blockchain network, token standard, and token. 2. Write ERC Token Smart Contract · Open up the my-token project in your code editor. · Navigate to your /contracts folder · Open a cupicup.ru file and name the. Read this guide to find out how you can create a cryptocurrency token in different ways and on various blockchains. create erc20, bep20 token and smart contract · Apcode ; do coinmarketcap circulating supply API for listing token · Sanjit ; create your own crypto memecoin, token. Create a token, create a coin for your project or yourself, or just trade others' coins. Craft your shiny new meme coin and turn your meme-tastic dreams into. Create your own cryptocurrency by joining hands with one of the Leading Cryptocurrency Coin Development Service provider, Shamlatech. Want to create your own token but unsure of how to start? Contact our expert crypto developers to launch crypto coin projects. What is createmytoken? createmytoken is an easy-to-use token generator for creating a ERC20/BEP20 Token on the Ethereum Blockchain or Binance Smart Chain. There. 1. Creating Your Own Blockchain and Cryptocurrency You can write your own code to create a new blockchain that supports a native cryptocurrency.

How to Create your own Crypto Token? · Step 1: Choosing the business issues that your tokens will address · Step 2: Identifying your target · Step 3: Selecting. If you don't want to create your own blockchain or need an option with the least coding possible, you can create a new cryptocurrency using an existing. You can create ERC20 tokens with our service. ERC20 is the most common technical standard for Ethereum-based smart contracts. Once a token is released, the. Step 1: Go to Token Tool and select the blockchain network · Step 2: Connect your wallet · Step 3: Define token properties · Step 4: Specify your own token's. Create My Token is an online tool to create and deploy your own ERC20 and BEP20 Tokens on many different blockchains such as Ethereum, BNB Smart Chain and more. Read this guide to find out how you can create a cryptocurrency token in different ways and on various blockchains. Using Token Tool, users can mint their own Coinbase Base tokens within minutes. You only need to specify the blockchain network, token standard, and token. Now, its perfectly legal and everyones getting in on creating and ICOs. I have a JavaScript for a token here. All anyone has to do to create their own coin is. Understanding the Basics: · Step-by-Step Guide to Creating and Selling Your Own Crypto Coin: · Define Your Objectives: · Choose the Right. With 'solana-token-creator' you can create a crypto within 2 minutes with just 1 command! The token creator is not compatible with Windows! We've made it super simple for anyone to create their own tokens on Ethereum, Binance Smart Chain, Fantom Chain, or Polygon Chain. No need to register, set up. How To Create Your Own Cryptocurrency: Step-by-Step Guide · Step 1: Research the Use Cases · Step 2: Choose a Consensus Mechanism · Step 3: Select a Blockchain. Create your own tokens. Generate tokenomics without coding. Professional token development. Decode Blockchain, Create Your Own Crypto Token, Grow It Alongside Bitcoin Ethereum Binance Avalache Solana Doge & Shiba. Creating your own cryptocurrency token on Team Finance is a straightforward process that can be accomplished in just a few clicks. Our user-friendly interface. Importance Of Creating Your Own Crypto Token By creating your own token, you have the freedom to customize its features and functionalities to. How to Create your own Crypto Token? · Step 1: Choosing the business issues that your tokens will address · Step 2: Identifying your target · Step 3: Selecting. You can create your own crypto currency without having your own blockchain. Use Etheruem's blockchain and pay for the fees (refered as GAS) to execute. It's time to create your new cryptocurrency by creating a token smart contract. Let's say you decide to build your own blockchain architecture and create the. Cryptocurrencies can be created by anyone with some technical programming knowledge. · Apart from paying someone to create it, there are three main ways of doing.

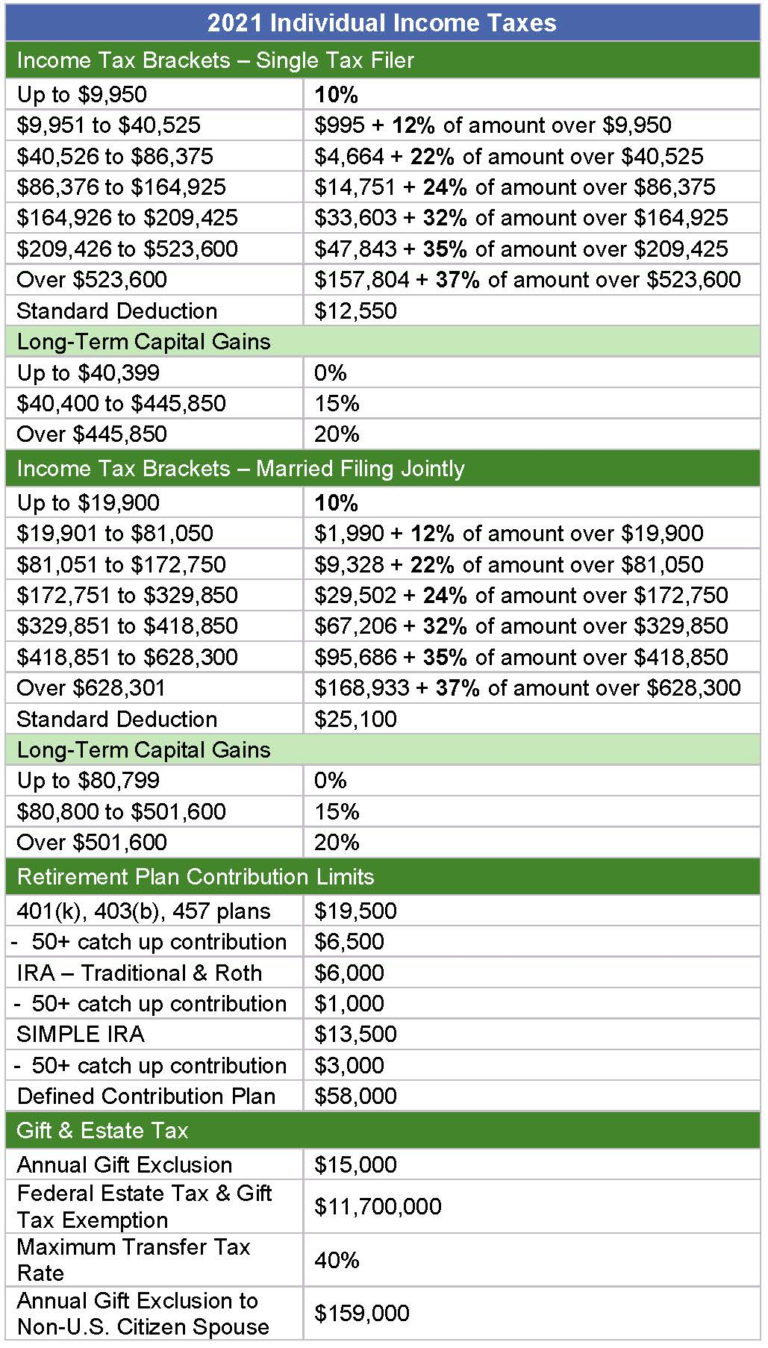

What Is The Federal Income Tax Brackets

Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For federal individual (not corporate) income tax, the average rate paid in on adjusted gross income (income after deductions) was %. However, the. Federal income tax rates are divided into seven segments (commonly known as income tax brackets). You pay increasing income tax rates as your income rises. federal income tax return to the Internal Revenue Service (IRS). Spouses Income Schedule separates New Mexico income so tax liabilities can be. The remaining amount would be taxed at per cent, which comes out to $1, In total, that employee paid $9, in federal tax. In , the first. 0% on the first $10, of taxable income.; 5% on the remaining taxable income in excess of $10, Tax Rates for Tax years The 4%. The Tax Rate Schedules are shown so you can see the tax rate that applies to all levels of taxable income. Don't use them to figure you tax. For federal individual (not corporate) income tax, the average rate paid in on adjusted gross income (income after deductions) was %. However, the. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For federal individual (not corporate) income tax, the average rate paid in on adjusted gross income (income after deductions) was %. However, the. Federal income tax rates are divided into seven segments (commonly known as income tax brackets). You pay increasing income tax rates as your income rises. federal income tax return to the Internal Revenue Service (IRS). Spouses Income Schedule separates New Mexico income so tax liabilities can be. The remaining amount would be taxed at per cent, which comes out to $1, In total, that employee paid $9, in federal tax. In , the first. 0% on the first $10, of taxable income.; 5% on the remaining taxable income in excess of $10, Tax Rates for Tax years The 4%. The Tax Rate Schedules are shown so you can see the tax rate that applies to all levels of taxable income. Don't use them to figure you tax. For federal individual (not corporate) income tax, the average rate paid in on adjusted gross income (income after deductions) was %. However, the. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is

Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. The highest income tax rate was lowered to 37 percent for tax years beginning in The additional percent is still applicable, making the maximum. Personal Income Tax ; %, 6th Tax Bracket over $, up to $,, %, 6th Tax Bracket over $, up to $, ; %, 7th Tax Bracket over. Federal Tax Brackets · 15 percent on the first $53, of taxable income. · percent on the next $53, (to $,). · 26 percent on the next $58, . The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Then indicate the amount or percentage. Canada Pension Plan (CPP). Be set at (new request) $ or. %. You may continue to itemize and deduct sales tax on your federal income tax returns. If you qualify to itemize your deductions on Form , Schedule A. 1 qualifying child: $3,; 2 qualifying children: $6,; 3 or more qualifying children: $7, Tax year Find the maximum. The top marginal federal income tax rate has varied widely over time (figure 2). The top rate was 91 percent in the early s before the Kennedy/Johnson tax. View benefit payment schedule · Communicate changes to personal situation You will pay federal income taxes on your benefits if your combined income. tax brackets and federal income tax rates ; 10%, $0 to $11,, $0 to $22, ; 12%, $11, to $44,, $22, to $89, ; 22%, $44, to $95,, $89, Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to a maximum of % on incomes exceeding. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return. Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status. Marginal tax rate: Your tax bracket explained ; Single Filing Status ; Income, Tax Bracket ; $11,, 10% ; $44,, 12% ; $95,, 22%. Income Tax Rates (on taxable income), % on first $40,, % on first $41, ; % on 40, to $80,, % on $41, to $82, ; % on. Effective July 1, percent of net income. IIT prior year rates. Personal Property Replacement Tax, Corporations – (other than S corporations). If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1,

How To Keep No See Ums Away

Insect repellents that contain essential oils like lemon, eucalyptus, mint, camphor, and picaridin are known for repelling no-see-ums. Home Remedies for No-See-Ums and Ankle Biters: · Apply mosquito repellent to any exposed skin before going outside. · Avoid being outside during dawn and dusk –. Get rid of standing water in and around the house. Look for places that trap water - gullys, choked drainage pipes, open containers, rubbish. These services use a variety of methods to help keep no-see-ums away from your home, including sprays, traps, and other devices. No-see-um control services can. PESKY Indoor / Outdoor Bug Stay Away Spray - helps to keep everything from spiders, mosquitos, no see ums, ants, snakes and more away from an area. PESKY Indoor / Outdoor Bug Stay Away Spray - helps to keep everything from spiders, mosquitos, no see ums, ants, snakes and more away from an area · Bug Soother. Set up CO2 traps to catch and kill no-see-ums. · Wear DEET repellent to keep no-see-ums away from you. · Spray lemon, eucalyptus, and citronella essential oils to. Once you've gotten your no-see-um infestation under proper control, you can take steps to keep these little troublemakers away. For instance, all midges. To prevent bites from no-see-ums, avoid being outside during the hours of dawn and dusk. You can also use an insect repellent containing DEET or one marked for. Insect repellents that contain essential oils like lemon, eucalyptus, mint, camphor, and picaridin are known for repelling no-see-ums. Home Remedies for No-See-Ums and Ankle Biters: · Apply mosquito repellent to any exposed skin before going outside. · Avoid being outside during dawn and dusk –. Get rid of standing water in and around the house. Look for places that trap water - gullys, choked drainage pipes, open containers, rubbish. These services use a variety of methods to help keep no-see-ums away from your home, including sprays, traps, and other devices. No-see-um control services can. PESKY Indoor / Outdoor Bug Stay Away Spray - helps to keep everything from spiders, mosquitos, no see ums, ants, snakes and more away from an area. PESKY Indoor / Outdoor Bug Stay Away Spray - helps to keep everything from spiders, mosquitos, no see ums, ants, snakes and more away from an area · Bug Soother. Set up CO2 traps to catch and kill no-see-ums. · Wear DEET repellent to keep no-see-ums away from you. · Spray lemon, eucalyptus, and citronella essential oils to. Once you've gotten your no-see-um infestation under proper control, you can take steps to keep these little troublemakers away. For instance, all midges. To prevent bites from no-see-ums, avoid being outside during the hours of dawn and dusk. You can also use an insect repellent containing DEET or one marked for.

Keep mosquitoes and no-see-ums out of your yard with our mosquito misting system, which works around the clock to keep these annoying biting insects away and. Made in the USA · Convenient, no-mess mist application · Packable 2oz bottle is perfect for the beach or travel · Uniquely formulated for no-see-ums, but also. 1 nearby at Hyde Park | mi away. Available Shipping. Delivery. Free Delivery. Add to Cart. Top Rated. When sitting on your patio or deck, an overhead fan or oscillating fan helps keep no-see-ums away from the area. Advertisement. Natural Repellent. You can. Having your AC running to cool down and dry out the air inside your home can deter no-see-ums from getting inside your property, as they avoid cold temperatures. Insect Shield clothing provides excellent protection from midge bites by covering arms, legs, neck and head without the toxicity and mess of DEET or other. Use an insect repellent with DEET to keep no-see-ums away. Spray the repellent on your skin or use a repellent candle to keep them out of a specific area. Tired of those tiny bothersome no-see-ums ruining your outdoor adventures? Say goodbye to their pesky bites with No-See-Um Repellent Mist. No-see-ums are at their worst when the sun is down, especially if there is no breeze. The chemical DEET, in a concentration of at least 30 percent helps. If you. Designed to help protect small areas like decks and patios before noseems are active, noseeum candles will help keep biting pests like noseeums, mosquitoes and. Where Do No-See-Ums Live? · How Can You Detect No-See-Ums? · You can get temporary relief from those stinging bites with bug sprays and repellents containing. I wasn't bothered by the no-see-ums even when away from the campfire/tiki torches. I did come back with 6 bug bites, but its the everglades in summer so I. Put screens on your doors and windows. Since noseeums are so tiny, it can be quite easy for them to sneak through a point of entry and make their way indoors. Looking for the best No-See-Ums Repellent on the market? Ranger Ready Picaridin 20% Insect Repellents will keep you and your family protected from. It also repels fleas and no-see-ums for even more relief. EPA Reg. No. I like that it helps to keep away much more than mosquitos, flies, and even ticks. Mesh Screens — Since no-see-ums are so small, normal window and door screens are not able to keep them out. These small biting insects have the ability to fit. The smell of the vinegar will attract the insects, and the dish soap is sticky enough that they won't be able to get away after landing in it. Choose the right. Margie Fox, owner of Garden Gate Nursery in Bluffton, South Carolina, shares a few natural ways to keep those pesky biting midges away. Put screens on your doors and windows. Since noseeums are so tiny, it can be quite easy for them to sneak through a point of entry and make their way indoors. To use it as a space spray, first ensure no people or pets are inside the home. Then, put away all food serving items (glasses, bowls, plates, pots) and eating.

Masters Degree At 26

Lyon, France. Sep 26, Join for Free. 10 seats left. Agenda. Sep We understand the challenges candidates face as they seek to obtain a Masters degree. Home>Academics>Graduate Schools>Master's degree programmes. Two-year | +33 (0)1 42 22 31 SUBSCRIBE TO OUR NEWSLETTERS. Subscribe. Follow us. More. Full-time or Part-time Master's Programs. Most students will complete their graduate programs full-time. As a full-time student, you will study. Set yourself apart as an expert teacher with a Master of Science in Education degree (MSEd). Iona's master's programs in education will advance your career as. Tuition for a project management degree can cost as much as $85,! GetEducated's rankings reveal all of the programs that cost less than the national average. It offers selected students the opportunity to undertake a fully funded one-year master's level programme at a higher education institution (HEI) in Ireland. QS Discover is an exclusive and free event with top master's programs under one roof waiting to meet you. Join our event to network with more than 25 top. 7/26/24 Current Student FAQs · 7/26/24 Forms for Students · 10/27/21 Graduate 8/12/24 Computer Science BS/Master of Science MBA · 8/12/24 Computer. It is never too late to start studying. If you're talking about applying for a degree to the US, you have to understand that this is an educational system that. Lyon, France. Sep 26, Join for Free. 10 seats left. Agenda. Sep We understand the challenges candidates face as they seek to obtain a Masters degree. Home>Academics>Graduate Schools>Master's degree programmes. Two-year | +33 (0)1 42 22 31 SUBSCRIBE TO OUR NEWSLETTERS. Subscribe. Follow us. More. Full-time or Part-time Master's Programs. Most students will complete their graduate programs full-time. As a full-time student, you will study. Set yourself apart as an expert teacher with a Master of Science in Education degree (MSEd). Iona's master's programs in education will advance your career as. Tuition for a project management degree can cost as much as $85,! GetEducated's rankings reveal all of the programs that cost less than the national average. It offers selected students the opportunity to undertake a fully funded one-year master's level programme at a higher education institution (HEI) in Ireland. QS Discover is an exclusive and free event with top master's programs under one roof waiting to meet you. Join our event to network with more than 25 top. 7/26/24 Current Student FAQs · 7/26/24 Forms for Students · 10/27/21 Graduate 8/12/24 Computer Science BS/Master of Science MBA · 8/12/24 Computer. It is never too late to start studying. If you're talking about applying for a degree to the US, you have to understand that this is an educational system that.

26 courses as possible while in the Master of Information Technology program. Additional Information. You can view current and past schedules for Rutgers. A handy step-by-step guide of how to apply for a Masters degree at the University of Leeds and information for agents who are helping applicants to apply. Process & Requirements. For more information, please email: [email protected] Apply for: All programs · Spring Sport Management (M.S.) Online. in the education field. Lonnie has expertise in the K and higher education settings as wel Updated on January 26, Edited by. Margaret Weinhold. In today's world, is a master's degree worth the time, effort and money? It's still often worth it, but it's starting to change in certain industries. List of all Postgraduate courses with application deadlines / Duration of the funding. 12 to 42 months (dependent on study programme). Value. Depending. JULY 26, Dissertation Forms. Doctoral Students: Final date to submit Graduate Program Staff: Priority deadline to submit the Approved Program Form and u. In short, getting a master's degree in your 40s is definitely doable—and it can actually be really good for your career. Going back to school is. Graduate at warp speed with accelerated degree programs. 26 Masters; Scholarships; Academic Staff; 3, Students; Private Institution Type. Master's. Virginia Hislop suited up in a cap and gown at age to receive her Master of Arts degree in education at Stanford University on June (Charles Russo). programs in Canada and accepts students across four sites. The MPT program is a month master's degree program that uses an integrated, case-based. Masters Degree Part Time jobs in Vancouver, BC. + jobs. English $26–$50 an hour. Full-time +3. French not required. Easily apply. EmployerActive. I graduated with a Masters Degree in Law(Natural Resources) from the University Last editedOpens edit history PM · Jan 26, ·. K. Views. MEng in Construction Engineering and Management (CE&M). This two-semester, credit program is designed for those with a bachelor's degree in civil engineering. Master's Degree Graduation Requirements. Office of the Registrar. On this May 26, (deadline to walk in Fall commencement), $, September 8, Page 26 of 43, Master Programs in Germany for ; Master in Paper Technology. Hochschule München University of Applied Sciences. Hochschule München. The Masters School is an independent school in New York with boarding and day school programs for middle school and high school. Average age: 26; Total enrollment: Flexible Options. Most classes are You can also complete your civil engineering graduate degree entirely online. Committee members must be able to evaluate the thesis/practicum in the chosen language. July 26, Page 5. Master's Degrees General Regulations 5. The. Choose from over graduate and professional programs that offer opportunities to learn across disciplines, in the classroom, online, hands-on here, or.

Profit Corporation Vs Llc

A limited liability company can be managed by managers or by its members. The management structure must be stated in the certificate of formation. Management. partnership unless it elects to be taxed as a corporation and the LLC with only one "For profit" corporations (other than S corporations, which are discussed. Profit distribution: Corporations have set rules for profit distribution based on the number and type of shares owned. In contrast, LLCs have more flexibility. No separate tax is imposed on the partnership entity. In contrast, the earnings of a corporation are taxed at the entity level; any dividends which are. While LLCs are often treated as pass-through entities, meaning the income of the LLC flows through to its members, S Corps are accounting entities, meaning the. Unlike a sole proprietorship, an LLC is a hybrid of a partnership and a corporation and it allows the liability protection of a corporation while providing the. The biggest difference is that corporations have “shareholders” and LLCs have “members.” Corporations tend to have many owners, while LLCs are now the most. Generally, a nonprofit corporation is recommended over a nonprofit LLC simply because a nonprofit corporation is a bit more practical. For starters, a. There are many from which to choose, including a sole proprietorship, general partnership, corporation, limited liability company, limited partnership, limited. A limited liability company can be managed by managers or by its members. The management structure must be stated in the certificate of formation. Management. partnership unless it elects to be taxed as a corporation and the LLC with only one "For profit" corporations (other than S corporations, which are discussed. Profit distribution: Corporations have set rules for profit distribution based on the number and type of shares owned. In contrast, LLCs have more flexibility. No separate tax is imposed on the partnership entity. In contrast, the earnings of a corporation are taxed at the entity level; any dividends which are. While LLCs are often treated as pass-through entities, meaning the income of the LLC flows through to its members, S Corps are accounting entities, meaning the. Unlike a sole proprietorship, an LLC is a hybrid of a partnership and a corporation and it allows the liability protection of a corporation while providing the. The biggest difference is that corporations have “shareholders” and LLCs have “members.” Corporations tend to have many owners, while LLCs are now the most. Generally, a nonprofit corporation is recommended over a nonprofit LLC simply because a nonprofit corporation is a bit more practical. For starters, a. There are many from which to choose, including a sole proprietorship, general partnership, corporation, limited liability company, limited partnership, limited.

If the business has leftover profits, they are distributed to shareholders as dividends, which have a lower tax rate than regular income does. Management. The LLC is a legal business distinct from its stakeholders (also called members). Accordingly, income and expenses from the LLC are taxed as passing through to. Limited Liability Company (LLC) A California LLC generally offers liability protection similar to that of a corporation but is taxed differently. Domestic. A limited liability company (LLC) combines certain characteristics of both a corporation and also a partnership or sole proprietorship (depending on how many. Raising Capital. Corporations may have an easier time raising capital than LLCs. Corporations have the ability to issue stock to finance corporate activities. Limited liability companies are permitted to engage in any lawful, for-profit business or activity other than banking or insurance. Doing business as an LLC may. Form · An LLC that has one member will be classified as a “disregarded entity.” A disregarded entity is one that is disregarded as an entity separate from. Limited Liability Company (LLC) · Limited personal liability for business debts even if you take part in management · Profit and loss can be allocated differently. LLC vs. Corporation · have limited liability for business owners · require owners to file paperwork with the state to create them · usually require owners to. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of. Corporate income is generally taxed lower than individuals, but you must file a separate corporate tax return, and when a distribution is made, then tax is paid. C corporations are assessed corporate taxes on their own profits (and have extensive filing obligations). Shareholders are taxed separately if the company. An LLC is a business structure where taxes are passed through to the owners. An S corporation is a business tax election in which an established corporation. Profits are paid to the owner. To partners according to The corporation pays corporate taxes separately from taxes paid by directors and shareholders. This tax designation avoids double taxation if you expect your LLC to be profitable. For an LLC or corporation to qualify for S corporation election, the. The limited liability company (LLC) is often the preferred choice by small business owners, because of their flexibility. LLCs have fewer formalities and don't. Limited Liability Company Limited Liability Companies (LLC) combines many favorable characteristics of corporations and partnerships. The LLC provides limited. A limited liability company (LLC) is similar to a corporation, but with slight differences. Like a corporation, it offers limited personal liability. An LLC is. A corporation is owned by shareholders and a limited liability company is owned by members. Both the corporate shareholder and the LLC member can be protected. Unlike the C corporation, an LLC that is properly structured will be treated as a partnership for federal and state income tax purposes, thus allowing earnings.

Irs Federal Tax Brackets 2021

Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Step 2: Apply the Tax Rates to Each Bracket · The first $11, of your taxable income is taxed at 10%. · The next portion of $33, (from $11, to $44,) is. Determine what counts as earned income for the Earned Income Tax Credit (EITC). Use EITC tables to find the maximum credit amounts you can claim for the. Get more details from the IRS about filing taxes when you get the premium tax credit. OTHER TAX YEARS. taxes · taxes · taxes · taxes. Eligible members of an electing pass-through entity (PTE) may claim a Hawai'i income tax credit for the pro rata share of PTE taxes paid. cupicup.rues@. Wages: (Gross income from paid work) ; Self-Employment: (self-employed and Schedule K-1 Income) ; Unearned Income: (Unemployment Insurance, Interest, ordinary. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. Tax Information for Individual Income Tax For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Tax brackets in ; 32%, $,– $,, $,– $, ; 35%, $,– $, (Single) $, – $, (MFS), $,– $, ; 37%, $, Earned income — income you receive from your job(s) — is measured against seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Step 2: Apply the Tax Rates to Each Bracket · The first $11, of your taxable income is taxed at 10%. · The next portion of $33, (from $11, to $44,) is. Determine what counts as earned income for the Earned Income Tax Credit (EITC). Use EITC tables to find the maximum credit amounts you can claim for the. Get more details from the IRS about filing taxes when you get the premium tax credit. OTHER TAX YEARS. taxes · taxes · taxes · taxes. Eligible members of an electing pass-through entity (PTE) may claim a Hawai'i income tax credit for the pro rata share of PTE taxes paid. cupicup.rues@. Wages: (Gross income from paid work) ; Self-Employment: (self-employed and Schedule K-1 Income) ; Unearned Income: (Unemployment Insurance, Interest, ordinary. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. Tax Information for Individual Income Tax For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. Tax brackets in ; 32%, $,– $,, $,– $, ; 35%, $,– $, (Single) $, – $, (MFS), $,– $, ; 37%, $,

Source: IRS Revenue Procedure Table 4. Personal Exemptions, Standard Deductions, Limitation on Itemized. Deductions, Personal Exemption Phaseout. Income Tax Brackets · $, for married individuals filing jointly and surviving spouses, · $, for single individuals and heads of households. 1. What is the income tax rate? · 2. Do I need to file my federal tax return first? · 3. I am mailing in my return. · 4. What filing status to I use on my return? Per OMB Circular A, federal travelers " must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Marginal tax rates ; $82, – $, ; $, – $, Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. The OASDI tax rate for self-employment income in is percent. For , , , , , , , , Note: Amounts for. The Arizona Department of Revenue will follow the Internal Revenue Service (IRS) announcement regarding the start of the electronic filing season. Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households ; 12%, $11, to $44,, $22, to. Income Tax Rates ; Personal Property Replacement Tax, Corporations – (other than S corporations). percent of net income. Partnerships, trusts, and S. Tax Rates ; January 1, – December 31, , % or ; January 1, – December 31, , % or ; January 1, – December 31, , %. Section 63(c)(2) of the Code provides the standard deduction for use in filing individual income tax returns. Near the end of each year, the IRS issues a. Click here to see the latest IRS Form The tax law, like almost all laws, grows as lawmakers use it for pork, try to make it fairer, use it to stimulate a. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Individual Income Tax Filing Open submenu; Estates, Trusts, and the Individual Income Calculator · Spouse Adjustment Tax Calculator. Close submenu. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid. For Tax Years , , and the North Carolina individual income tax rate is % (). · For Tax Years and , the North Carolina individual. Additional federal forms, such as IRS Schedule 1 and IRS Schedule A, may also be required to compute an individual's federal taxable income. Modifications.

Gopocket

Go Pocket, ethereum scaling focused wallet. On-The-Go Pocket Shorts " · 3 1/2" inseam, 1 1/2" covered elastic waistband with drawcord for personalized fit · Secure back side pockets and hidden front. Go Pocket is a next-gen crypto wallet. It focuses on providing real-time and dynamic security services & best user-experience. Pocket (cupicup.ru) API client for Go (golang). - motemen/go-pocket. Buy STOP & GO POCKET TIRE PLUGGER KIT from Dvorak Motorsports in Bismarck, North Dakota. Our Price from: $ NozzleTire pugging deviceWeight: 12 oz. Pocket (cupicup.ru) API client for Go (golang). - motemen/go-pocket. Trade like a pro on NSE, BSE & MCX with GoPocket's mobile app & web platform. Experience real-time charts, multiple features in watchlist & more. pocket:= cupicup.ru(key, token) url:= "http://an-interesting-article" title:= "Won't be used if correctly parsed by Pocket, so it's just a backup. Go Pocket is a multi-chain cryptocurrency wallet that offers security to crypto users. Go Pocket, ethereum scaling focused wallet. On-The-Go Pocket Shorts " · 3 1/2" inseam, 1 1/2" covered elastic waistband with drawcord for personalized fit · Secure back side pockets and hidden front. Go Pocket is a next-gen crypto wallet. It focuses on providing real-time and dynamic security services & best user-experience. Pocket (cupicup.ru) API client for Go (golang). - motemen/go-pocket. Buy STOP & GO POCKET TIRE PLUGGER KIT from Dvorak Motorsports in Bismarck, North Dakota. Our Price from: $ NozzleTire pugging deviceWeight: 12 oz. Pocket (cupicup.ru) API client for Go (golang). - motemen/go-pocket. Trade like a pro on NSE, BSE & MCX with GoPocket's mobile app & web platform. Experience real-time charts, multiple features in watchlist & more. pocket:= cupicup.ru(key, token) url:= "http://an-interesting-article" title:= "Won't be used if correctly parsed by Pocket, so it's just a backup. Go Pocket is a multi-chain cryptocurrency wallet that offers security to crypto users.

Launching GoPocket: The Ultimate Stock Trading App for Smart Investors!" The ultimate stock trading app designed for smart investors! GoPocket. 13 likes. GoPocket is a tool for you to stay online while you phone is in your pocket. It disable /lock touch screen and soft key to prevent. Polaroid Go Pocket photo album white: Keep your Polaroid Go photos safely in this album. Sturdy and lightweight, it holds up to 36 photos. On the Go Pocket Leggings provide the perfect balance of comfort and convenience. Made of super soft brushed fabric, these leggings give a luxurious feel. Small investment, big opportunities — Begin your future with GoPocket! Your financial future starts here. Start your investing with a minimum amount with. GoPocket - Online trading platform that simplifies trading and offers easy-to-understand modules for learning the basics. Letting Go Pocket Power Pamphlet, 16 pp. One of Hazelden's most popular series, Pocket Power pamphlets provide quick inspiring recovery references. In a. Followers, Following, Posts - Go Pocket! (@cupicup.ru) on Instagram: "GO POCKET is a strong stick-on Pocket to hold your phone or necessities. GoPocket. @GoPocket_Official. 13 subscribers•3 videos. Trading and Investing made Swift, Secure and Simple for millions. more more cupicup.ru Subscribe. Green-Go Pocket Ball Washer - Lowest Prices and FREE shipping available from The Award Winning Golf Store - Morton Golf Sales. Go Pocket - Go Pocket is a new generation multi-chain wallet that provides security safeguard for Crypto users. - Security entrance for Crypto users. Explore Go Pocket blockchain game with an overview of key metrics, analytics, NFT trading data and news. Get the latest insights and trends on DappRadar. GoPocket's Webflow site highlights their secure trading app with zero brokerage for 30 days and a quick account setup. Will my GoPocket Points expire? How do I buy GoPocket points? Will my purchased points expire? GoCar Malaysia · Powered by Zendesk. Tap on the menu icon Tap on GoPocket Tap on Buy Points Select one of the options You'll be redirected to make payment to complete your. Configure GoPocket Sky Commodities. Configure-GoPocket. To connect Configure Go Pocket account with Tradetron, you need to follow the following steps. Lets Go Pocket Tight 25 · Warrenty. No code needed, just head for checkout! · Free shipping. All orders are dispatched the next business day! · We will beat any. Go - Pocket Diaper Our diapers feature a PUL water-resistant outer layer, meaning leakage through the exterior fabric is an extremely low risk. PUL is a. GoPocket - Online trading platform that simplifies trading and offers easy-to-understand modules for learning the basics. The Polaroid Go Pocket Photo Album holds 36 photos. Get yourself one of the 3 colors and keep your memories with you everywhere you go.

Open A Checking Account Online With Bank Of America

Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Many banks and credit unions let you open a checking account online. For others, you need to apply in person at a local branch. To verify your identity and. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Yes. Opening online is easy but because of rampant fraud it may require more steps. If you go to a branch and open it, it's just done. You must be enrolled in Business Advantage , our small business online banking platform, and have an open Bank of America small business deposit account to. Enroll in our Online Banking and get easy and secure access to your accounts—anytime, anywhere. Check account balances and transactions, transfer funds between. We offer 3 convenient ways to open a business checking account: Choose your business checking account and apply online; Call · Visit a financial. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Mobile and Online Banking give you secure access to your accounts from almost anywhere so you can bank with confidence on your schedule to accomplish more. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Many banks and credit unions let you open a checking account online. For others, you need to apply in person at a local branch. To verify your identity and. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Yes. Opening online is easy but because of rampant fraud it may require more steps. If you go to a branch and open it, it's just done. You must be enrolled in Business Advantage , our small business online banking platform, and have an open Bank of America small business deposit account to. Enroll in our Online Banking and get easy and secure access to your accounts—anytime, anywhere. Check account balances and transactions, transfer funds between. We offer 3 convenient ways to open a business checking account: Choose your business checking account and apply online; Call · Visit a financial. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Mobile and Online Banking give you secure access to your accounts from almost anywhere so you can bank with confidence on your schedule to accomplish more.

Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. How to open the checking account · Enter your personal information, including proof of address, and employment type · Request (if available) a debit card for. Bank of America's suite of banking products and services. Savings · Credit cards · Mobile and online access · All solutions. Choose Your Checking Account · MasterCard® Debit Card · Just a $25 opening deposit · Manage your accounts with access to online and mobile banking. A smarter way to spend, save and plan ahead is here. Open a checking account and get access to Erica, 1 your virtual financial assistant right in the Mobile. Bank anytime, anywhere. Open a new account, deposit a check, check balances, make bill payments and more – all from our mobile app on your smartphone or tablet. View our personal checking accounts—whether you want a no minimum balance account or to earn interest, we have options for you. Open a checking account. Bank of America offers several different checking account options. Each connects to the bank's highly rated mobile app to help you manage your finances. What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Learn more about bank account options for students, teens, and young adults. Review fees and requirements for opening a bank account at Bank of America. You can open a bank account online with Bank of America by going to its website and selecting the account type you want from the navigation menu. On that. Open an account online at any time, from anywhere. Choose from a personal checking, savings or money market account. Banks should not allow opening new accounts online with only SSN. When it happened to me I went to the branch in person and they called. For debit card transactions, claims must be reported within 60 days of the statement. Bank of America · Online Banking · Get Answers for. Ready to open your Bank of America Advantage Banking account? Meet with a specialist at one of our many financial centers. Simply pick a time and location. Log in to Online Banking using each User ID. Be sure to check the box that says Save User ID before you select the Log In button. The next time you visit the. Go to a Bank of America branch and take some money with you, Drivers License or any type of a state or federal ID with your photo and current. Open a new BofA checking account through a promotional offer or by using a Bank of America offer code. This is an online offer only. Meet the promotion's. Learn about the convenience and ease of depositing paper checks into your account using the Mobile Banking app with Mobile Check Deposit from Bank of America.