cupicup.ru

Tools

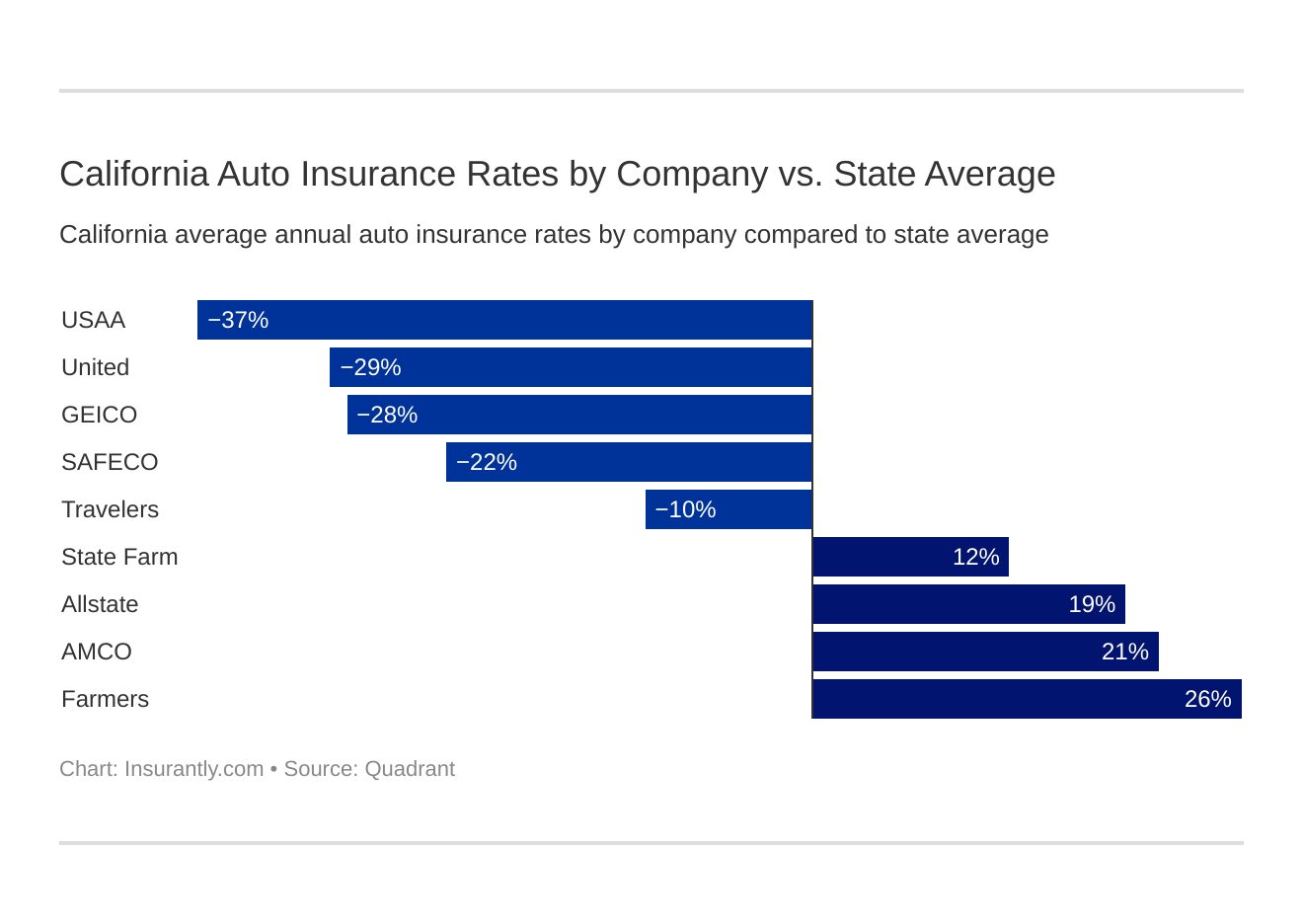

Average Car Insurance Rates California

Car insurance rates average $ in California. Compare quotes from Mile Auto, Sun Coast, Mercury, and more. California, $2,, $3, ; Colorado, $2,, $3, ; Connecticut, $1,, $2, ; Washington, D.C., $2,, $3, The average cost for car insurance in California is $1, Average costs range from $ with Wawanesa to $1, with Pure Insurance. Car insurance. The average annual car insurance cost in San Francisco is $ This is more expensive compared to the state's average of $ and the national average of $. The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. California. Average full coverage car insurance in California costs 12 percent more per year than the national average. High insurance costs in the Golden State. On average, drivers who switched to Allstate saved $, so get your Ways you can save on Allstate car insurance rates. We offer plenty of ways to. The monthly average cost of car insurance for drivers in the US is $ for full coverage and $53 for minimum coverage. Car insurance rates average $ in California. Compare quotes from Mile Auto, Sun Coast, Mercury, and more. California, $2,, $3, ; Colorado, $2,, $3, ; Connecticut, $1,, $2, ; Washington, D.C., $2,, $3, The average cost for car insurance in California is $1, Average costs range from $ with Wawanesa to $1, with Pure Insurance. Car insurance. The average annual car insurance cost in San Francisco is $ This is more expensive compared to the state's average of $ and the national average of $. The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. California. Average full coverage car insurance in California costs 12 percent more per year than the national average. High insurance costs in the Golden State. On average, drivers who switched to Allstate saved $, so get your Ways you can save on Allstate car insurance rates. We offer plenty of ways to. The monthly average cost of car insurance for drivers in the US is $ for full coverage and $53 for minimum coverage.

Multi-car discount – more autos means more savings! Good student discount – high school and college students who maintain a "B" average qualify. Persistency. What are California's minimum auto insurance requirements? ; Bodily injury liability, What it coversInjuries you cause to others in an accident, Minimum amount. Minimum California Car Insurance Coverage · Bodily injury liability coverage: $15, per person / $30, per accident minimum · Property damage liability. In contrast, the average cost for full-coverage insurance in California is $ per month or $2, per year. Average insurance rates can offer insight to help. The links below provide helpful insurance information and an interactive tool for consumers to use to obtain a premium comparison between insurance companies. On average, car insurance policy rates do increase by around 46% when a driver is involved in an accident that causes an injury. Currently, the average driver in California pays $1, annually in car insurance. That may seem like a lot, but California drivers aren't the only ones to see. Mercury Insurance provides California car insurance with low rates from local CA agents. Get an affordable auto insurance quote in just minutes! The average cost of car insurance for a California driver with a clean record is $2, per year, or about $ per month for coverage that includes liability. We compiled our insurance data from thousands of insurance quotes across the country. The average cost of car insurance in the United States is about $ The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. What are the cost for a CLCA policy? The average cost of car insurance in California. There are many things involved in determining auto insurance rates. How many miles you drive a year, your. The average cost of car insurance is $50 per month or $ per year for liability-only car insurance across the US. Louisiana, Florida and California drivers pay the highest car insurance rates in the nation. · Maine, New Hampshire and Vermont have the cheapest car insurance. The average annual premium for drivers in California is $1,, based on our sample data. The California Department of Insurance mandates providers set premiums. The average cost of liability in California is $53 per month. However, not only will you probably never be quoted this amount, you may not want it anyway. Among SelectQuote customers, the average cost of car insurance in California is $+ per month. Car insurance rates in California will vary based on driving. Car insurance averages about $2, a year for full coverage in California and $ a year for minimum coverage, according to Bankrate. Individual rates vary. Average Car Insurance Cost by Category · Minimum Coverage: $56 per month · Full Coverage: $ per month · Drivers with a Violation: $71 per month · Young Drivers.

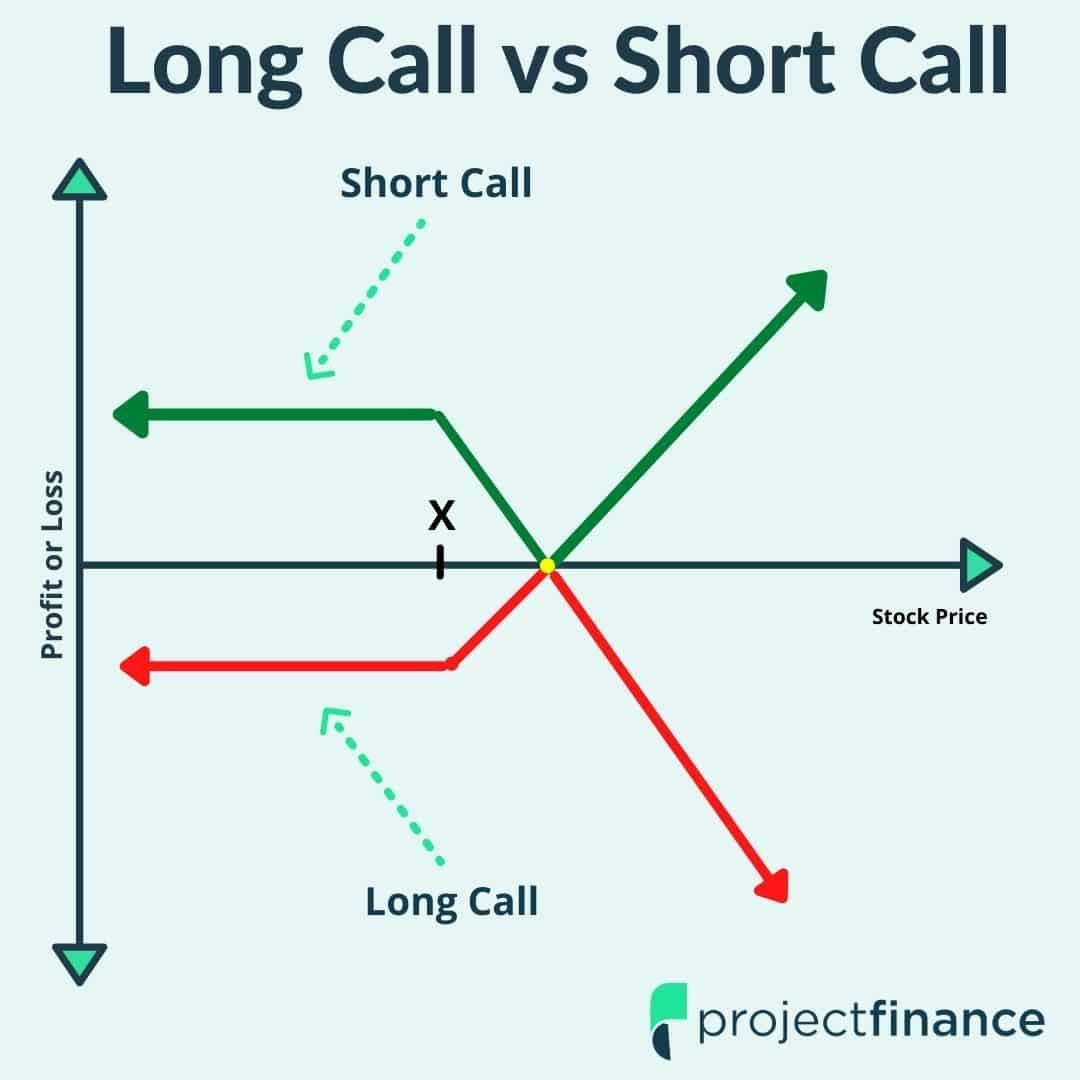

How Does An Option Call Work

When you buy a call option, you're buying the right to purchase a work as you expect it to. The information does not usually directly identify. A call option is a contract between two parties wherein one party has the right, but not the obligation, to buy a certain underlying asset at a pre decided. A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. Traders would sell a put. When you hold put options, you want the stock price to drop below the strike price. If it does, the seller of the put will have to buy shares from you at the. When you write an option, you're the person on the other end of the transaction. For example, if you write a call, the buyer could choose to exercise it if the. Calls If a stock is trading at $50 and you think it's going to go up to $60, you might buy a $55 "call" option for say, 20 cents. If the stock. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. A call option contract gives the buyer the right, but not the obligation, to buy shares of a stock or bond at a stated price on or before the contract's. A call option, is an options to buy a stock at a preset price. Let's say Acme Corporation is currently trading at $9 a share. When you buy a call option, you're buying the right to purchase a work as you expect it to. The information does not usually directly identify. A call option is a contract between two parties wherein one party has the right, but not the obligation, to buy a certain underlying asset at a pre decided. A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. Traders would sell a put. When you hold put options, you want the stock price to drop below the strike price. If it does, the seller of the put will have to buy shares from you at the. When you write an option, you're the person on the other end of the transaction. For example, if you write a call, the buyer could choose to exercise it if the. Calls If a stock is trading at $50 and you think it's going to go up to $60, you might buy a $55 "call" option for say, 20 cents. If the stock. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. A call option contract gives the buyer the right, but not the obligation, to buy shares of a stock or bond at a stated price on or before the contract's. A call option, is an options to buy a stock at a preset price. Let's say Acme Corporation is currently trading at $9 a share.

A buyer of call option speculates that the security prices will rise, therefore, they take position at a lower strike price and make profit when the securities'. The call option works by giving the right that is purchased by the buyer paying an upfront premium to the seller. The seller, after receiving this premium. A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. Traders would sell a put. A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known. A call option, is an options to buy a stock at a preset price. Let's say Acme Corporation is currently trading at $9 a share. How it works: · Buying a put option: When you purchase a put option, you are essentially expecting that the price of the underlying stock will fall below the. An index call option is the right to buy an index, and the profit/loss will depend on the movement in the index value. Thus, you have Nifty Calls, Nifty Bank. Calls may be the most well-known type of option. They offer the chance to purchase shares of a stock (usually at a time) at a price that is, hopefully. How Call Options Work A call option can be purchased if the buyer thinks the underlying market is going to go up in price. The biggest advantage of buying a. A call option is a contract that entitles the owner the right, but not the obligation, to buy a stock, bond, commodity or other asset at set price before a set. A covered call gives someone else the right to purchase stock shares you already own (hence "covered") at a specified price (strike price) and at any time on. An available three month option would be an Dabur three month call. The call will give an option to the buyer of the contract the right, but not the. A buyer of call option speculates that the security prices will rise, therefore, they take position at a lower strike price and make profit when the securities'. However, if the price of the underlying asset does exceed the strike price, then the call buyer makes a profit. The amount of profit is the difference between. A call option is a contractual agreement that grants investors the right, but not the obligation, to buy securities such as bonds, stocks, or commodities at a. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. Call options provide an investor with the right, unbound by any obligation, to buy an asset at a certain price. When the buyer of the call option exercises his call option, the seller has no other option but to sell the underlying asset at the strike price. However, this. A call option is a contract wherein the buyer is vested with the right to purchase the underlying asset at a predetermined price within the stipulated.

Cross Collateral Lenders

:max_bytes(150000):strip_icc()/terms-c-cross-collateralization-0cb8f66776c346949f9b7cf236ecefbc.jpg)

Private money and hard money multi-property blanket loans are a great way to reposition mortgage debt across a portfolio of investment properties. Cross-collateralization allows businesses to use existing collateral as security for multiple loans. This means a single asset can back several loans. Cross collateralization is the act of using one asset as collateral to secure multiple loans or multiple assets to secure one loan. It involves using the same collateral for different loans. Some businesses are able to convince lenders to accept property already serving as collateral for. Cross-collateralization. Property given as security under this Plan or for any other loan Borrower has with the credit union will secure all amounts. Cross-collateralization and cross-default provisions are not just technical jargon. These terms refer to when a borrower uses more than one. The Easy Move Cross Collateral loan will finance the purchase price plus closing costs as long as the total is less than $, without requiring the. Cross collateralization is a lending practice that involves using multiple assets as collateral to secure a loan or multiple loans. In this arrangement, the. Cross-collateralization of assets is a financing strategy used by borrowers to leverage multiple properties as collateral to secure a single loan from the. Private money and hard money multi-property blanket loans are a great way to reposition mortgage debt across a portfolio of investment properties. Cross-collateralization allows businesses to use existing collateral as security for multiple loans. This means a single asset can back several loans. Cross collateralization is the act of using one asset as collateral to secure multiple loans or multiple assets to secure one loan. It involves using the same collateral for different loans. Some businesses are able to convince lenders to accept property already serving as collateral for. Cross-collateralization. Property given as security under this Plan or for any other loan Borrower has with the credit union will secure all amounts. Cross-collateralization and cross-default provisions are not just technical jargon. These terms refer to when a borrower uses more than one. The Easy Move Cross Collateral loan will finance the purchase price plus closing costs as long as the total is less than $, without requiring the. Cross collateralization is a lending practice that involves using multiple assets as collateral to secure a loan or multiple loans. In this arrangement, the. Cross-collateralization of assets is a financing strategy used by borrowers to leverage multiple properties as collateral to secure a single loan from the.

Cross collateralization agreements are a form of security that can be used as collateral for many different loans. They also allow for the use of one property. Cross collateralization generally is 80% loan to value on the initial property. Getting a residential appraisal with the comparables you need is difficult as. Cross collateralisation is when an investor uses more than one property as security for a loan. For example, let's say Jane Doe wants to purchase a $, Cross-collateral loans are an innovative financing solution that allows homeowners to harness the equity in their current home to fund the. Cross-collateralization is when a lender uses the collateral you put up for one loan, such as a car, to secure another loan you take out with that same lender. A cross-collateral loan allows the investor to use some type of owned asset, such as a house or savings account, as collateral to borrow funds. Cross Collateralization Real Estate Loans is the act of using property with an existing loan as collateral for another loan or they use multiple assets to. Cross Collateralizing Loans. A cross-collateralized loan is a loan that is secured by more than one property. This means that the borrower is using multiple. Cross-Collateralized Loans Collateralized loans are a convenient way to obtain money quickly for businesses that have difficulties getting a traditional. With cross collateralization, the lender is able to add extra collateral to the loan, making it more desirable. If your credit rating is not as strong as a. The Easy Move Cross Collateral loan is $, minus the existing mortgage of $, which equals $, The Easy Move Cross Collateral loan will finance. Key Takeaways · Cross collateralization is a method used by lenders like credit unions to use the collateral of one loan product to secure another one. A cross-collateral loan uses the same asset as security for multiple loans, offering benefits like increased borrowing capacity and better terms. When your loans are cross collateralised, and you decide to sell one, the bank will revalue the properties that will be held once the sale is completed. They'll. Cross-collateralization and cross-default provisions are not just technical jargon. These terms refer to when a borrower uses more than one. This information is prepared for real estate and mortgage professionals only. It is not intended for public distribution or consumer information. In reality, the mortgage lender can be at a beneficial position for using cross collateralization, since it gives them more security for the loan. If the. Cross-collateralized loans are a key choice in commercial finance. They let borrowers use more than one asset as loan security. This boosts flexibility and. When your loans are cross collateralised, and you decide to sell one, the bank will revalue the properties that will be held once the sale is completed. They'll. I was just informed that I could cross collateralize my current residence which I have equity of about $K so I would not need to come up with the 25% down.

What Would Be A Good Company To Invest In

Sometimes there is a good reason the price is so low. The answer to all of the questions above is probably a publicly-traded company that you can invest in. Sales Growth Rate: This measures the annual increase in a company's total revenue. A consistent growth rate in sales over multiple years is a strong indicator. To compile the list of Kiplinger's best stocks to buy, we looked for high-quality companies that boast solid fundamentals such as strong earnings and revenue. Shares is the most interesting category of Investing. You can choose between two paths for what you want to use shares for. Companies may pay dividends to shareholders or may prefer to reinvest profits for further growth. Benefits of investing in shares. Part-ownership of a company. How does investing in stocks work? When you buy stock in a company, you become a part-owner of the company in proportion to the number of shares you purchase. 44 votes, 55 comments. I'm trying to find good new investments. I've struggled with finding company's to invest in before. Where do I start. invest heavily in shares of your employer's stock or any individual stock. If that stock does poorly or the company goes bankrupt, you'll probably lose a. Look at its historical financial performance, including revenue and net income growth over the years. Additionally, compare the company's. Sometimes there is a good reason the price is so low. The answer to all of the questions above is probably a publicly-traded company that you can invest in. Sales Growth Rate: This measures the annual increase in a company's total revenue. A consistent growth rate in sales over multiple years is a strong indicator. To compile the list of Kiplinger's best stocks to buy, we looked for high-quality companies that boast solid fundamentals such as strong earnings and revenue. Shares is the most interesting category of Investing. You can choose between two paths for what you want to use shares for. Companies may pay dividends to shareholders or may prefer to reinvest profits for further growth. Benefits of investing in shares. Part-ownership of a company. How does investing in stocks work? When you buy stock in a company, you become a part-owner of the company in proportion to the number of shares you purchase. 44 votes, 55 comments. I'm trying to find good new investments. I've struggled with finding company's to invest in before. Where do I start. invest heavily in shares of your employer's stock or any individual stock. If that stock does poorly or the company goes bankrupt, you'll probably lose a. Look at its historical financial performance, including revenue and net income growth over the years. Additionally, compare the company's.

A company's ability to raise dividends consistently can demonstrate profitability. Companies that have excess cash flow and strong financial positions often choose. If you're interviewing for a job in finance, talking about your investment strategy is a great way of impressing the hiring manager. Company next earning dates, economic calendar (that can be sorted and Very good app. I like just about everything about it - ESPECIALLY for one. If you're considering a bond investment at this company, you should research if investing in equities or bonds is a good idea. Pfizer Inc (NYSE: PFZR). Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. These tend to be solid but low-growth companies. But if a company reports strong revenue growth initially—even if it fails to turn a profit in its early days—growth investors may still decide it's a good. Does the company face any economic, political or cultural risks? The good news is that you can find most of the answers to these questions in just a few. Find ways to invest in your employees' skills. Employee development is the most important investment a company can make. By investing in employee skills. Great! But now what? Here's the good news: investing in companies is really not that different from investing in anything else. I'm just wondering what people's strategies are for finding new companies. I'm fairly new to this. What things should I learn. Companies sell shares typically to gain additional money to grow the company. This is called the initial public offering (IPO). After the IPO, stockholders can. Before deciding which investment vehicles are appropriate for you, it'll help if you know what they are, how they work, and why they may be a good fit for your. 1) Apple Inc. (AAPL) · 2) Microsoft Corporation (MSFT). Microsoft is a multinational technology company established in and headquartered in Redmond. Whether or not you use that data to guide your investment strategy? That will be up to you. See how your company performs. Get started with Certification™ to. This flaw could be a lack of inventory (local bookstore vs. Amazon) or a mismatch between supply & demand (taxi company). Before buying a business, you should. His basic proposition to managers is that to the degree that a company spins off cash, which good businesses do, the managers can trust Warren to invest it. While essential, a “good idea” is not enough. A number of additional factors weigh into venture capital decisions, including the team, the proof of concept, the. But if a company reports strong revenue growth initially—even if it fails to turn a profit in its early days—growth investors may still decide it's a good. strong, positive returns. There's no guarantee that the company whose stock you hold will grow and do well, so you can lose money you invest in stocks.

Interactive Brokers Tradingview Integration

TradingView Interactive Brokers Integration using Webhooks - hackingthemarkets/tradingview-interactive-brokers. With just a few simple steps, you can have s of charts and statistics, trade charts and insights all automatically generated for all your InteractiveBrokers. The API (connection) issued by Interactive Brokers (IBKR) to TradingView, works well. I've been using this combination for 2+ years now. With the integration of TradingView, CapTrader offers you another way to implement your trading strategies. Whether you are an experienced trader who. Third Party Integration · Interactive Advisors. Education. Back. EDUCATION. IBKR Interactive Brokers ®, IBSM, cupicup.ru ®, Interactive Analytics. integration between TradingView and Interactive Brokers (IBKR). This powerful combination TradingView and Interactive Brokers (IBKR). Head over to TradingView, open a Trading Panel, and find Interactive Brokers in the list. Click connect. If you're not logged into your brokerage account, you'. We have no immediate plans for adding compatibility with TradingView Mobile, but your feedback has been passed along to the appropriate teams. For mobile. In order to do this, you need to connect to your Interactive Brokers account in the trading panel. You'll then be granted 7 days access, after which you'll need. TradingView Interactive Brokers Integration using Webhooks - hackingthemarkets/tradingview-interactive-brokers. With just a few simple steps, you can have s of charts and statistics, trade charts and insights all automatically generated for all your InteractiveBrokers. The API (connection) issued by Interactive Brokers (IBKR) to TradingView, works well. I've been using this combination for 2+ years now. With the integration of TradingView, CapTrader offers you another way to implement your trading strategies. Whether you are an experienced trader who. Third Party Integration · Interactive Advisors. Education. Back. EDUCATION. IBKR Interactive Brokers ®, IBSM, cupicup.ru ®, Interactive Analytics. integration between TradingView and Interactive Brokers (IBKR). This powerful combination TradingView and Interactive Brokers (IBKR). Head over to TradingView, open a Trading Panel, and find Interactive Brokers in the list. Click connect. If you're not logged into your brokerage account, you'. We have no immediate plans for adding compatibility with TradingView Mobile, but your feedback has been passed along to the appropriate teams. For mobile. In order to do this, you need to connect to your Interactive Brokers account in the trading panel. You'll then be granted 7 days access, after which you'll need.

The TradingView - Interactive Brokers integration plugin allows users to link their TradingView account with their Interactive Brokers account, making it. Now, for the first time, regular retail investors and traders can automatically place trades in any Interactive Brokers account whenever, wherever. The TWS Application Program Interface (API) accommodates connection to a variety of third-party vendors (e.g. TradingView, Multi Charts, Ninja Trader) who offer. What Integrates with Interactive Brokers? · Sharesight · Build Alpha · Quantower · TradesViz · JigSaw Trading · Claritus · TradingView · EndoTech. With the TradingView integration, trade stocks, futures, leveraged FOREX and bonds on over global markets; Fund your account and trade assets in TradingView's integration with eToro makes trading easy by combining social trading with advanced technical analysis tools. Forex traders can access. Integrate TradingView directly with your broker. TradeStation brokers like Tradovate, TradeStation, Coinbase, Interactive Brokers and Alpaca. customer service at tradingview sucks too. they don't respond at my Brokerage integration · Partner program · Education program. All Brokers and Integrations · Charles Schwab · CoinBase · CoinBase Pro · Ctrader · DXtrade · Das Trader Pro · Generic · Interactive Brokers. What brokers can I trade through on TradingView? · A1 Capital; · Activtrades; · Afterprime; · Alice Blue; · Alor; · Alpaca; · AMP; · Binance;. TradingView Interactive Brokers Integration using Webhooks. Demo Video: cupicup.ru?v=zsYKfzCNPPU. - Margin rates up to 49% lower than other brokers. - IB SmartRouting℠ helps support best execution by searching for the best available prices across exchanges. Currently, the integration between Interactive Brokers and TradingView supports Stocks, Futures, and Leveraged Forex trading. Non-tradable Symbols In. Interactive Brokers helps Investors globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. To find all tradable symbols for Interactive Brokers, connect to them via the Trading Panel, then open the Symbol Search. Find answers to any questions about how to use TradingView — charts, trades, billing, data, desktop & mobile apps and much more. TradingView Interactive Brokers Integration with Python. Part Time Larry · Interactive Brokers QuantConnect Cloud Integration. Part Time. Tradingview supports integration with dozens of brokers globally across stocks, options, forex and crypto. Popular US stock brokers like Etrade. To connect TradingView to Interactive Brokers for executing trades, you need to generate webhook messages and send them to a webserver's public endpoint. We've integrated it with our other financial education offerings on. @IBKR_Campus. Find all the API tools from Interactive Brokers here: cupicup.ru

Credit Card Shares

We believe credit card stocks today may represent a “trough on trough” opportunity and a substantial margin of safety for investors. Build credit easily with the Magnolia Share Secured Visa® credit card. Apply Now Order your card online The time to start building better credit is now. Enjoy the Benefits of a Share Secured Visa Credit Card · Establish or Repair Credit · Secured by Your Savings · Competitive Interest Rates · No Annual Fee or. Share-Secured Card · This card is an option for the member looking to open their first credit card or to re-establish credit. · The credit limit for this card is. Our share secured VISA is perfect if you need to build or rebuild your credit history with monthly reporting to all 3 major credit bureaus. Visa Credit Cards If you're looking to improve your credit score or have little-to-no credit history, a Share Secured Visa® can empower you to build your. The top 5 credit card issuers by market share are Chase, American Express, Citi, Capital One, and Bank of America, which collectively control more than 50%. FAB SHARE Standard Credit Card · Get up to 7% value back in SHARE points at Carrefour for every AED spend · Get up to % value back in SHARE points on all. SBI Card Share Price: Find the latest news on SBI Card Stock Price. Get Credit Card Debit Payoff Calculator. TOOLS; Provident Fund Calculator · Assets. We believe credit card stocks today may represent a “trough on trough” opportunity and a substantial margin of safety for investors. Build credit easily with the Magnolia Share Secured Visa® credit card. Apply Now Order your card online The time to start building better credit is now. Enjoy the Benefits of a Share Secured Visa Credit Card · Establish or Repair Credit · Secured by Your Savings · Competitive Interest Rates · No Annual Fee or. Share-Secured Card · This card is an option for the member looking to open their first credit card or to re-establish credit. · The credit limit for this card is. Our share secured VISA is perfect if you need to build or rebuild your credit history with monthly reporting to all 3 major credit bureaus. Visa Credit Cards If you're looking to improve your credit score or have little-to-no credit history, a Share Secured Visa® can empower you to build your. The top 5 credit card issuers by market share are Chase, American Express, Citi, Capital One, and Bank of America, which collectively control more than 50%. FAB SHARE Standard Credit Card · Get up to 7% value back in SHARE points at Carrefour for every AED spend · Get up to % value back in SHARE points on all. SBI Card Share Price: Find the latest news on SBI Card Stock Price. Get Credit Card Debit Payoff Calculator. TOOLS; Provident Fund Calculator · Assets.

Having both a University Share Secured Credit Card and a University Checking Account helps you earn up to % APY for the banking you already do! Yes, you can use money from your credit card to invest in the stock market and mutual funds. However, it's important to be cautious when. With an LSFCU Platinum Visa Credit Card, you are guaranteed NO GIMMICKS and NO FINE PRINT. We always offer members these great, money saving features. Benefit from great value back in SHARE points on your groceries, shopping and spending in the UAE and abroad– with no limits on your points earning. Using a credit card to invest in stocks is bad both in theory and in practise, so you should avoid doing it. Here's why. Hawaii State FCU's Share Secured Visa Platinum Rewards Credit Card is great if you're looking to build or re-establish your credit. Apply online today! The Share Secured Visa Credit Card from Guadalupe Credit Union is specifically designed for members looking to establish or rebuild their credit. Do not buy stocks with a credit card. If things go belly up, you'll owe the interest. City CU offers share secured credit cards which are backed by a deposit, the amount of which becomes your spending limit. Apply today. Credit Card ETF List. ETFs which hold one or more stocks tagged as: Credit Card. Symbol. The real risk is going to be Discover. Visa and MC are just processors (mostly), and the risk is held by the issuer. Discover and Amex are. The global credit card payment market size was valued at USD billion in and is projected to reach a value of USD billion by It can be beneficial for a couple to share a credit card if one has a great credit history and the other has what they call a “thin file,” Bryan Kuderna, a. PMC Group offers a wide variety of functional polymer additives to manufacturers of calendered films, foils, credit card stock and other specialty plastics. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. The top 5 credit card issuers by market share are Chase, American Express, Citi, Capital One, and Bank of America, which collectively control more than 50% of. The Provident Share Secured Visa Credit Card helps build or re-establish a positive credit history. Apply online today. Our Visa® Platinum Share Secured Credit Card works like any other credit card but minus the effects of indiscriminate spending. EMV chip high quality plastic smart contactless card stock for Visa/Mastercard debit & credit cards. Figure 5 displays the major components of ROA as shares of credit card receivables: net interest income, net non-interest income, and loan loss provision.

Dow Jones Yesterday Result

Like the Swiss Market Index (SMI), the Dow Jones is a price index. The shares included in it are weighted according to price; the index level represents the. Dow Jones 30 Weekly Price Forecast – Dow Jones 30 Continues to Reach Higher result of using any information contained in the cupicup.ru website may. Get Dow Jones Industrial Average .DJI:Dow Jones Global Indexes) real-time stock quotes, news, price and financial information from CNBC. The current value of Dow Jones Industrial Average Index is 41, USD — it has risen by % in the past 24 hours. Track the index more closely on the Dow. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The most recent DJIA closing value in this data set is on August 22, The History of the Dow Index. On July 3, , Charles Henry Dow began. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Discover historical prices for ^DJI stock on Yahoo Finance. View daily, weekly or monthly format back to when Dow Jones Industrial Average stock was issued. Like the Swiss Market Index (SMI), the Dow Jones is a price index. The shares included in it are weighted according to price; the index level represents the. Dow Jones 30 Weekly Price Forecast – Dow Jones 30 Continues to Reach Higher result of using any information contained in the cupicup.ru website may. Get Dow Jones Industrial Average .DJI:Dow Jones Global Indexes) real-time stock quotes, news, price and financial information from CNBC. The current value of Dow Jones Industrial Average Index is 41, USD — it has risen by % in the past 24 hours. Track the index more closely on the Dow. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The most recent DJIA closing value in this data set is on August 22, The History of the Dow Index. On July 3, , Charles Henry Dow began. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Discover historical prices for ^DJI stock on Yahoo Finance. View daily, weekly or monthly format back to when Dow Jones Industrial Average stock was issued.

Interactive chart of the Dow Jones Industrial Average (DJIA) stock market index for the last years today's latest value. Dow Jones publishes the world's most trusted business news and financial information in a variety of media. It delivers breaking news, exclusive insights. The Global Dow · 4, 4,, %, PM ; Dow Jones · 41, 40,, %, PM ; NASDAQ · 19, 19,, result to the previous value. The AD Line should confirm an advance or a decline with similar movements. S&P Advance / Decline Line · Dow Jones Advance /. Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components The Dow Divisor today (August ) is For example, if an index were composed of three stocks with share prices of $13, $17, and $70, then the. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. S&P 5, (%) · Market Movers · Sector Performance · Market Map · Key Indicators · Economic Calendar · Invest in U.S funds · News. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. The Dow Jones Sustainability™ World Index comprises global sustainability leaders as identified by S&P Global through the Corporate Sustainability. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. The Dow Jones Industrial Average (also known as: DJIA, the Industrial Average, Dow Jones, DJI, the Dow 30) measures the stock performance of thirty leading blue. View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more. More contact details are available here, including phone numbers for all regional offices. Suggested Citation: S&P Dow Jones Indices LLC, Dow Jones Industrial. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Top U.S. Markets ; 41,, +, +%Positive ; 17,, +, +%Positive. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Dow Jones Industrial Average News · Wall Street Journal sued for 'hostility' over remote work · Stock Market Today: Bank earnings, small cap stocks surge · Stock. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Get Schwab's latest stock market update at market close. Learn how market events, economic indicators, and earnings reports impacted the day's market.

Forex Usd To Cad

%. (1Y). US Dollar to Canadian Dollar. 1 USD = CAD. Sep. USD to CAD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Canadian Dollar. The current rate of USDCAD is CAD — it has decreased by −% in the past 24 hours. See more of USDCAD rate dynamics on the detailed chart. CME listed FX futures offer more precise risk management of CAD/USD exposure through firm pricing, convenient monthly and quarterly futures and weekly, monthly. The USDCAD spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the CAD. While the USDCAD spot exchange rate. US Dollar / Canadian Dollar FX Spot Rate ; Open: ; Bid: ; Ask: Get the latest market information on the USD/CAD pair, including USD/CAD live rate, news, US Dollar - Canadian Dollar forecast and analysis. Currency Converter. Convert from Canadian dollars based on daily exchange rates. ; RSS feeds. Subscribe to our feeds to get the latest exchange rate data. USD/CAD slips below as the BoC reduces interest rates by 25 bps to % as expected. The US Dollar corrects sharply after weak US JOLTS Job Openings. %. (1Y). US Dollar to Canadian Dollar. 1 USD = CAD. Sep. USD to CAD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Canadian Dollar. The current rate of USDCAD is CAD — it has decreased by −% in the past 24 hours. See more of USDCAD rate dynamics on the detailed chart. CME listed FX futures offer more precise risk management of CAD/USD exposure through firm pricing, convenient monthly and quarterly futures and weekly, monthly. The USDCAD spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the CAD. While the USDCAD spot exchange rate. US Dollar / Canadian Dollar FX Spot Rate ; Open: ; Bid: ; Ask: Get the latest market information on the USD/CAD pair, including USD/CAD live rate, news, US Dollar - Canadian Dollar forecast and analysis. Currency Converter. Convert from Canadian dollars based on daily exchange rates. ; RSS feeds. Subscribe to our feeds to get the latest exchange rate data. USD/CAD slips below as the BoC reduces interest rates by 25 bps to % as expected. The US Dollar corrects sharply after weak US JOLTS Job Openings.

Heading to the U.S. and need to exchange your Canadian dollars? Or have extra USD on hand and want to convert it back? This quick and easy Foreign Exchange. All the technical data, charts, tools and indicators you need to analyze and trade the USD/CAD or see the Editorial side instead! US Dollar/Canadian Dollar FX Spot Rate · Price (CAD) · Today's Change / % · 1 Year change% · 52 week range - U. S. Dollar (USD). Canadian Dollar (CAD) Why should I convert my Canadian dollars to a foreign currency in Canada, before travelling to other countries? Current exchange rate US DOLLAR (USD) to CANADIAN DOLLAR (CAD) including currency converter, buying & selling rate and historical conversion chart. How to trade USD/CAD CFDs An individual can trade USD to CAD with either a forex contract or alternatively, they can trade a contract for difference (CFD) on. This Free Currency Exchange Rates Calculator helps you convert US Dollar to Canadian Dollar from any amount. FX: USD – CAD Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. This page is a resource that provides live USD to CAD rates as well as a graph, a brief description of what factors affect the exchange rate, and why it. Find the latest CAD/USD (CADUSD=X) currency exchange rate, plus historical data, charts, relevant news and more. Find the latest USD/CAD (CAD=X) stock quote, history, news and other vital information to help you with your stock trading and investing. 1 US dollar to Canadian dollars. Convert USD to CAD at the real exchange rate. Amount. 1 usd. Converted to. cad. $ USD = C$ CAD. Mid-market. Get US Dollar/Canadian Dollar FX Spot Rate (CAD=:Exchange) real-time stock quotes, news, price and financial information from CNBC. US Dollar to Canadian Dollar Exchange Rate is at a current level of , up from the previous market day and down from one year ago. Get the latest United States Dollar to Canadian Dollar (USD / CAD) real-time quote, historical performance, charts, and other financial information to help. The Canadian dollar or the Loonie is the seventh-most-traded currency in the Forex Market. The CAD is produced by the Royal Canadian Mint. This exchange rate tells you how many Canadian Dollars you need to buy one US Dollar. For example, if the USD/CAD pair is trading at , it means that you. Detailed price information for Canadian Dollar/U.S. Dollar (FOREX: CADUSD) from The Globe and Mail including charting and trades. Check live exchange rates for 1 USD to CAD with our USD to CAD chart. Exchange US dollars to Canadian dollars at a great exchange rate with OFX. USD to CAD. All Bank of Canada exchange rates are indicative rates only, obtained from Daily exchange rates: Lookup tool. Search and download exchange rate data.

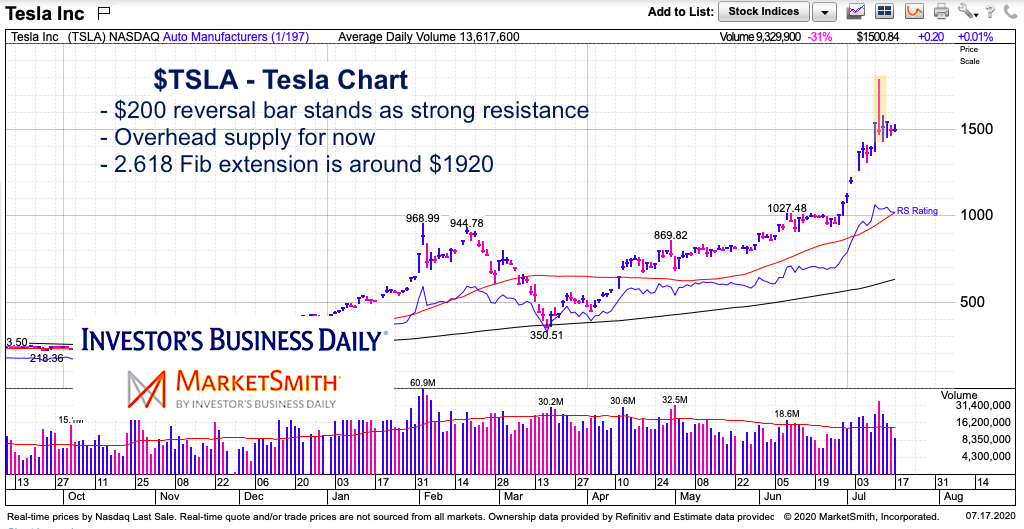

Tesla Stock Price Today Chart

Tesla Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The Tesla stock price is closed at $ with a total market cap valuation of $ B (B shares outstanding). The Tesla is trading on NASDAQ with the. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio TSLA Tip: Try a valid symbol or a specific company name for relevant. Tesla Inc. ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. At a Glance. Tesla, Inc. 1 Tesla Road. Austin, Texas Phone, See the latest Tesla Inc stock price (NASDAQ:TSLA), related news Chart · News · Price vs Fair Value · Sustainability · Trailing Returns · Financials. Tesla Inc TSLA:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/15/23 · 52 Week Low · 52 Week. Key Statistics ; P/E Ratio ; Shares Outstanding B ; Price to Book Ratio ; Price to Sales Ratio ; 1 Year Return –%. Find the latest Tesla, Inc. (TSLA) stock quote, history, news and other vital information to help you with your stock trading and investing. Tesla Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The Tesla stock price is closed at $ with a total market cap valuation of $ B (B shares outstanding). The Tesla is trading on NASDAQ with the. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio TSLA Tip: Try a valid symbol or a specific company name for relevant. Tesla Inc. ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. At a Glance. Tesla, Inc. 1 Tesla Road. Austin, Texas Phone, See the latest Tesla Inc stock price (NASDAQ:TSLA), related news Chart · News · Price vs Fair Value · Sustainability · Trailing Returns · Financials. Tesla Inc TSLA:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date09/15/23 · 52 Week Low · 52 Week. Key Statistics ; P/E Ratio ; Shares Outstanding B ; Price to Book Ratio ; Price to Sales Ratio ; 1 Year Return –%. Find the latest Tesla, Inc. (TSLA) stock quote, history, news and other vital information to help you with your stock trading and investing.

Get the latest Tesla Inc (TSLA) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Real-time Price Updates for Tesla Inc (TSLA-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. Values delayed up to 15 minutes. Today's Range: - 52 Week Range: - Profile · Charts · Financials · Key Metrics · All Listings. Tesla Inc. · AT CLOSE PM EDT 08/26/24 · USD · % · Volume59,, 16 minutes ago. View the real-time TSLA price chart on Robinhood and decide if you want to buy or sell commission Tesla Shares Are Trading Lower Today: What You Need To Know. Price Bid $; Price Ask $; Size Bid ; Size Ask Today High $ Ex Dividend Date: N/A. Intraday history. Table –Intraday history; Chart –. Nasdaq provides NLS Volume, Previous Close, Today's High & Low, and the 52 week High & Low. The intraday chart, the last-five real-time quotes and sales data. Tesla (TSLA) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD. Historical daily share price chart and data for Tesla since adjusted for splits and dividends. The latest closing stock price for Tesla as of August Discover real-time Tesla, Inc. Common Stock (TSLA) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. The 92 analysts offering price forecasts for Tesla have a median target of , with a high estimate of and a low estimate of Tesla Inc (TSLA) · Price Chart · Key Stats · Ratings · Profile · Ratings · Profile · Related Economic Indicators. Get Tesla Inc (TSLA) real-time share value, investment, rating and financial market information from Capital. Friendly Platforms & Trading today. Trading Statistics ; Stock Price. Open: ; Volume. Stock: 36,, ; Volatility. Today's Stock Vol: ; Corporate. Div. Yield: ; Descriptive. Type: Common. Tesla | TSLAStock Price | Live Quote | Historical Chart ; Sensata Technologies, , , % ; TE Connectivity, , , %. Tesla Inc. advanced stock charts by MarketWatch. View TSLA historial stock data and compare to other stocks and exchanges. Aug PM · Tesla Finance VP Departs in Latest Executive Exit at Automaker. (The Wall Street Journal) % ; PM · S&P Gains and Losses Today. Monitor the latest movements within the Tesla Inc real time stock price chart below. The Tesla Inc stock price today is What Is the Stock. Get the latest Tesla stock news and chart analysis, stock ratings and TSLA stock prices.

Best Used Car Loans For Good Credit

The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Whether you are buying a car, truck, or SUV from a car dealer or from a private seller and need to be pre-approved for a loan, we can help you finance your. To get the best interest rate on your car loan, compare auto loans and be mindful of the interest rates, terms and fees quoted by each lender. The best way to. Select from a variety of options that best meet your lifestyle. Southland has you covered. Features. Better than a bank! Enjoy low credit union rates that. Good and quick service. · Car Loan · Best experience · I like the culture · Yes i would again · I would use SCU again · I would use this credit union again for any. Handle communications with the dealer on your behalf; Negotiate pricing to get you the best deal; Deliver your new or pre-owned car straight to your door. Go to your bank or credit union. Apply for a car loan for a certain amount and they'll presumably have a better rate than the dealership. Many dealers offer 0% APR offers on new vehicles and low APR loans (under 3%) for certified pre-owned vehicles. But you'll likely need excellent credit to. I've always had the best luck with credit unions, and they usually publish their rates online. Just look around to get an idea. The dealer might. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Whether you are buying a car, truck, or SUV from a car dealer or from a private seller and need to be pre-approved for a loan, we can help you finance your. To get the best interest rate on your car loan, compare auto loans and be mindful of the interest rates, terms and fees quoted by each lender. The best way to. Select from a variety of options that best meet your lifestyle. Southland has you covered. Features. Better than a bank! Enjoy low credit union rates that. Good and quick service. · Car Loan · Best experience · I like the culture · Yes i would again · I would use SCU again · I would use this credit union again for any. Handle communications with the dealer on your behalf; Negotiate pricing to get you the best deal; Deliver your new or pre-owned car straight to your door. Go to your bank or credit union. Apply for a car loan for a certain amount and they'll presumably have a better rate than the dealership. Many dealers offer 0% APR offers on new vehicles and low APR loans (under 3%) for certified pre-owned vehicles. But you'll likely need excellent credit to. I've always had the best luck with credit unions, and they usually publish their rates online. Just look around to get an idea. The dealer might.

If you have a high credit score (for example, a VantageScore® of + or a FICO® score of +), you'll have a good chance of getting a car loan, and one that. Looking to finance a new or used car? See if you pre-qualify for financing in minutes with no impact to your credit score. Plus, know your financing terms. Average Rates for a Used Car ; Near prime, , %, $26,, ; Prime, , %, $28,, New, Used or Refinanced Car Loans, Genisys is your Best Financing Option! Buying a car should be an exciting time, but we know how stressful finding the. Best from a big bank: Capital One Auto Finance · Best from a credit union: PenFed Auto Loans · Best for rate shopping: myAutoloan · Best for a simple online. best deal all-around with pricing reports, competitive rates, and flexible terms. New & Used Auto Loan Rates. Rates as low as, Term, Loan Amount, Approx. Loan. Auto Loan Benefits & Features. As a not-for-profit credit union, we offer great rates, fewer fees and member-only benefits. Lower interest rates. Get your new or used car loan from Alliant today! Use our car loan calculator to learn how to get your best rate. Apply online in minutes. Are you a DMV-area resident struggling to buy a car because you can't quality for an auto loan? The only way to defeat bad credit is to build good credit. Purchase a New or Used Auto · No pre-payment penalty · Loan options for members who have experienced past credit problems. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Car Loan Rates · First National Bank • Used Car Loan • 72 Months · LightStream • Used Car Loan • 72 Months · Popular Bank • Used Car Loan • 72 Months · WSFS Bank •. Rates as of Aug 24, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Rates as of Aug 24, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. If you have a high credit score (for example, a VantageScore® of + or a FICO® score of +), you'll have a good chance of getting a car loan, and one that. Average Used Auto Loan Rate for Excellent Credit. Credit Score, Interest Rate. or higher, %. Splash Financial Personal Loans. It's worth considering a personal loan through Splash if you have good credit (ideally, a FICO score above ). The platform. Whether you're looking to purchase a new or pre-owned vehicle or refinance your current ride, rely on us for your automobile loan. You'll find competitive. Looking to finance a new or used car? See if you pre-qualify for financing in minutes with no impact to your credit score. Plus, know your financing terms. Find the best auto loan rates for new and used vehicles today. Refinance Rates quoted assume excellent borrower credit history. Not all applicants.